Global Economic Outlook: Uncertainty Reigns Supreme

15-June-2023

The Chief Economists Survey by WEF revealed a lack of consensus among economists about the global economy. For example, 45% of respondents said a global recession in 2023 was somewhat or extremely likely, while the same proportion said it was somewhat or extremely unlikely. This suggests that there is little agreement about how to interpret and weigh the latest economic data and developments.

The uncertainty surrounding the global economy makes it difficult for policymakers, businesses, and households to plan for the future. The survey results highlight the continuing ambiguity that clouds many economic developments, which in turn makes it difficult to make informed decisions.

The banking disruption in March 2023 may have intensified the lack of consensus among economists. The collapse of Silicon Valley Bank caused financial distress in the global financial system, which may have made it more difficult to interpret and weigh the latest economic data.

The global economic outlook for 2023 is one of patchy growth. The IMF forecasts global growth of 2.8% this year, with anaemic growth in advanced economies and stronger growth in emerging markets.

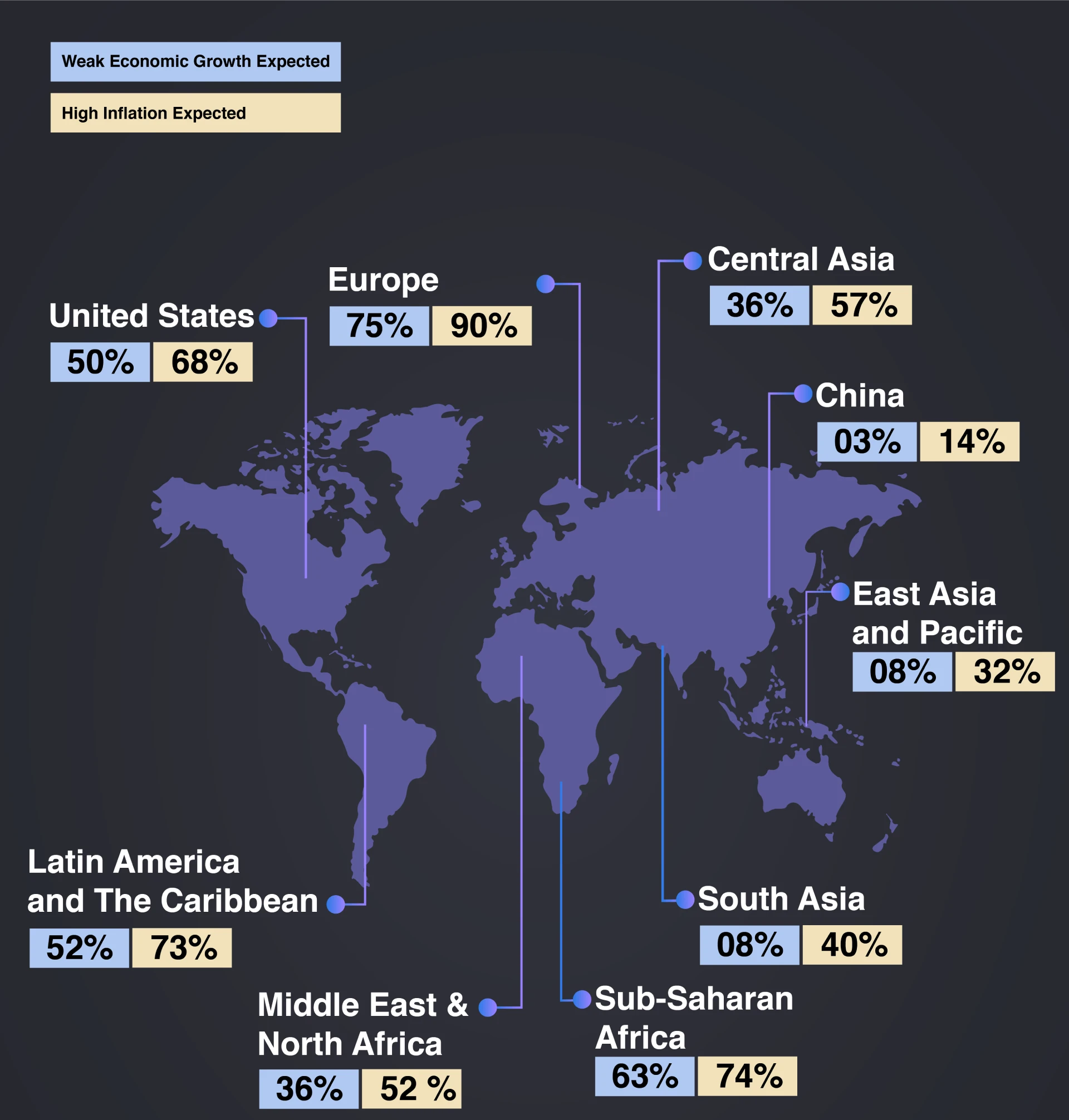

The outlook for different regions varies widely. China is expected to see moderate or better growth, while Europe, Latin America, and Sub-Saharan Africa are expected to see weak growth. The United States is evenly split between economists who expect weak or very weak growth and those who expect moderate or strong growth.

Inflation is expected to remain high in most regions, with Europe, the United States, Sub-Saharan Africa, and Latin America all expecting high or very high inflation. China is the only region where inflation is not expected to be high.

The main factors that are driving the global economic outlook are the war in Ukraine, the COVID-19 pandemic, and rising interest rates. The war in Ukraine is disrupting global supply chains and causing energy prices to rise.

A series of bank failures and government-backed takeovers shook the global financial system in March 2023. While fears of a systemic financial crisis are low, concerns persist about pockets of vulnerability in the banking sector.

The survey found that while nearly 70% of respondents viewed the recent distress as isolated incidents rather than signs of systemic vulnerability, almost the same proportion anticipated further bank failures or financial disruptions in the current year. The International Monetary Fund (IMF) cautioned that even isolated bank failures increase the risk of a harsh economic downturn.

Apart from the risks in the banking sector, the survey also highlighted the likelihood of spillover effects in the real economy as banks adopt a more cautious approach to lending in order to strengthen their balance sheets. Approximately 82% of chief economists predicted that businesses would face increased difficulty in obtaining bank loans following this year’s financial disruption.

While the worst of the financial crisis may have passed, the fear and volatility it caused have reignited debates on banking sector regulation. The survey revealed considerable uncertainty among chief economists, with similar proportions of respondents expecting no further changes, additional national measures, or further national and global measures in terms of regulatory actions. When asked about specific regulatory measures, respondents identified four key areas: stricter regulation and supervision of small and mid-sized banks, higher liquidity standards, enhanced oversight of non-bank financial institutions, and strengthened stress testing.

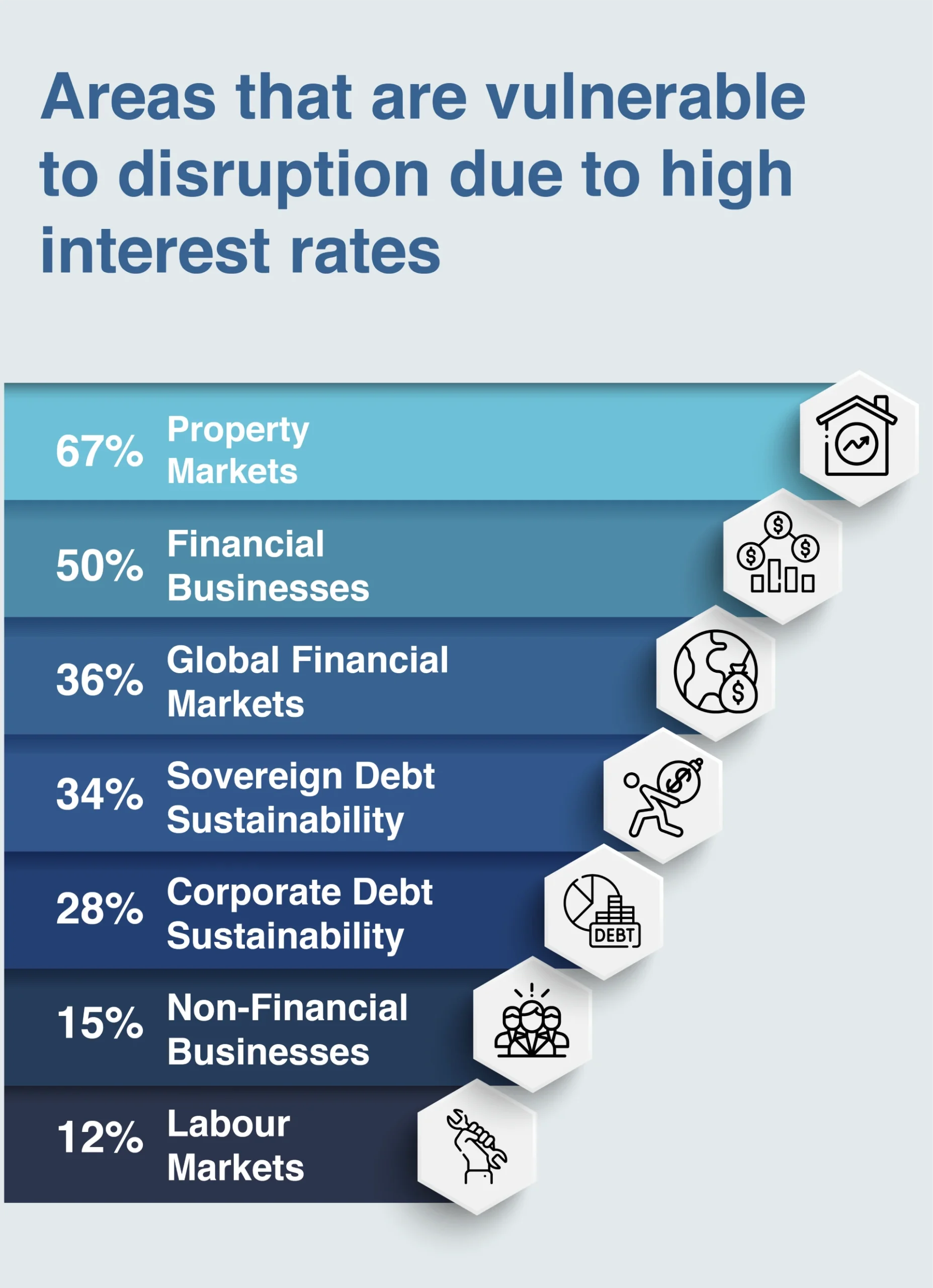

The actions taken by the two most systemically important central banks, the US Federal Reserve and the European Central Bank, have shown mixed results. The Federal Reserve raised rates by 25 basis points in March 2023, the first increase of less than 50 basis points since the previous year. In contrast, the European Central Bank continued its rate hikes by another 50 basis points in March 2023. Even if central banks adopt a more accommodative stance, a widespread shift towards monetary loosening is unlikely. The era of ultra-low rates has ended, and concerns arise regarding vulnerabilities in the face of higher borrowing costs. According to the surveyed chief economists, the property markets are the greatest source of concern, with 67% of respondents expecting significant disruption due to higher rates in 2023-24. Financial businesses, global financial markets, and the sustainability of sovereign and corporate debt also ranked high as areas of concern. Interestingly, labor markets raised little worry, as nearly two-thirds of respondents expected tight labor markets to persist in most advanced economies throughout the year.