Global Financial Inclusion: Progress and Opportunities - 2021

14-MAR-2023

In 2021, 76% of adults globally had an account with a regulated financial institution, such as a bank, credit union, microfinance institution, or mobile money service provider. Over the decade spanning from 2011 to 2021, the percentage of adults holding such accounts increased by 50%, rising from 51% to 76%.

Although account ownership increased in both high-income and developing economies, the average rate of growth in developing economies was much steeper. In Sub-Saharan Africa, this expansion largely stems from the adoption of mobile money.

Additionally, the gender gap in account ownership across developing economies has narrowed to 6 percentage points from 9 percentage points.

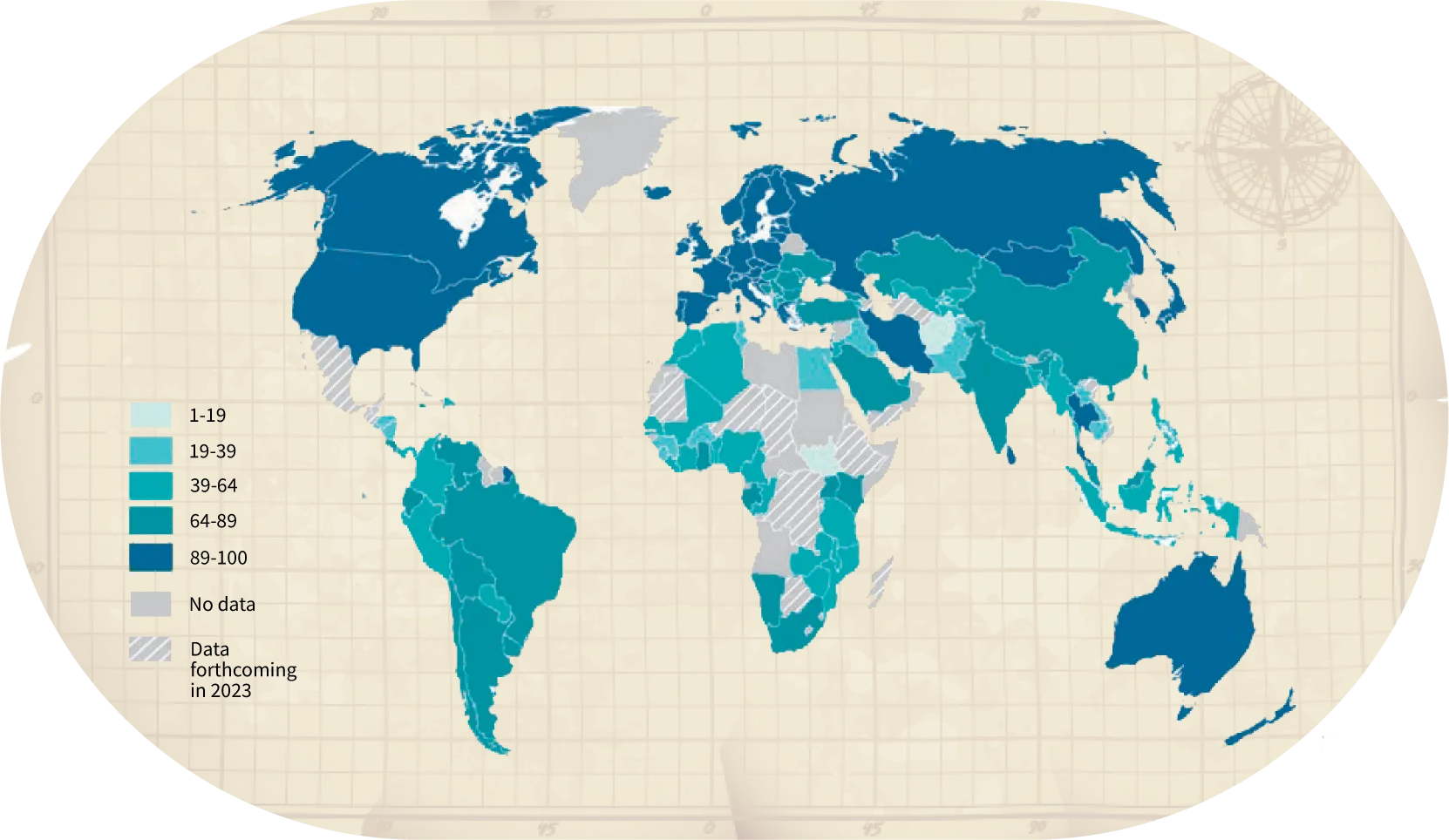

Account ownership rates vary across the world

Adults with an account (%), 2021

Between 2014 and 2021, there was a significant increase in the percentage of adults in developing economies who made or received digital payments, rising from 35% to 57%. In high-income economies, the share of adults making or receiving digital payments is nearly universal (95%).

Receiving payments directly into an account is often the first step towards utilizing other financial services. Notably, among adults in developing economies who received digital payments, 83% also made digital payments, up from 66% in 2014 and 70% in 2017. Additionally, almost two-thirds of digital payment recipients utilized their account to store money for cash management, while around 40% utilized it for saving. Furthermore, 40% of payment recipients accessed formal borrowing through their account.

In 2021, 18% of adults in developing economies paid utility bills directly from an account. About one-third of these adults did so for the first time after the beginning of the COVID-19 pandemic.

The share of adults making digital merchant payments also increased after the outbreak of COVID-19. For example, about 80 million adults in India made their first digital merchant payment during the pandemic. In China, 82% of adults made a digital merchant payment in 2021, including over 100 million adults (11%) who did so for the first time after the start of the pandemic. In developing economies, excluding China, 20% of adults made a digital merchant payment in 2021. These data point to the role of the pandemic and social distancing restrictions in accelerating the adoption of digital payments.

In developing economies, only 55% of adults could access emergency money within 30 days without much difficulty. Friends and family were the first-line emergency money sources for 30% of adults in developing economies, but nearly half of those said the money would be hard to get. Women and the poor were less likely than men and wealthier individuals to successfully raise emergency money and more likely to rely on friends and family as their go-to source.

About 50% of adults in developing economies were worried about covering health expenses in the event of a major illness or accident. In Sub-Saharan Africa, worry over school fees was the most common worry overall (for 54% of adults) and the biggest worry for 29%. Eighty-two per cent of adults in developing economies were very worried (52%) or somewhat worried (30%) about the continued financial toll of the COVID-19 pandemic.

Lowering Barriers and

Improving Infrastructure

The data shows that lack of money, distance to the nearest financial institution, and insufficient documentation were the primary reasons for the 1.4 billion unbanked adults around the world. However, these barriers present opportunities for addressing financial inclusion. By increasing inclusive access to trusted identification systems and mobile phones, it is possible to reach hard-to-reach populations and expand account ownership. The data also revealed that leveraging digital payments for wages, government transfers, or the sale of agricultural goods is an opportunity to drive financial inclusion and expand the use of financial services.

Digitalizing payments is a proven way to increase account ownership, as evidenced by the fact that 39% of adults in developing economies opened their first account specifically to receive a wage payment or government transfer, and this number is even higher when excluding mobile money accounts.